Contactless payments may have only been around since 2007, but we already cannot remember life before this little payment miracle. Their introduction has changed the payment landscape forever, making payment transactions so fast that you can pay for your coffee before the button is even pressed to produce it!

In August of this year, contactless payments accounted for 62 per cent of all UK debit card transaction.*

This shift is confirmed further with The Guardian reporting that The Royal Mint is to stop production of £2 and 2p coins (for at least a decade), due to excess stock. It also claims that cash demand fell by 71% between March and April of this year, right at the start of the pandemic.

“As lockdown restrictions continued to be eased in August, we saw record numbers of customers choosing to make contactless payments using debit cards. Contactless card transactions using either debit or credit cards also increased compared to July, suggesting that consumers are taking advantage of the £45 contactless spending limit.

Meanwhile, the amount of spending on UK debit cards fell slightly in August following a record high in July but remained strong at £58.4 billion.”

Said Eric Leenders, Managing Director of Personal Finance, UK Finance.

What does this mean for coffee vending machines?

This means that if you do not have a card reader on your bean to cup vending machine you are potentially missing out on 50% of sales. We also know that if users have the option of paying by card they are more likely to purchase on impulse, as a trip to a vending machine is not usually a planned visit.

This means that if you do not have a card reader on your smart vending machine you are potentially missing out on 50% of sales. We also know that if users have the option of paying by card they are more likely to purchase on impulse, as a trip to a snack vending machine is not usually a planned visit.

How do I get a contactless payment device on my industrial vending machine?

Well that is easy, every commercial coffee machine that leaves our workshop has a device fitted! So you don’t need to do anything to offer your end user a simple and seamless transaction.

What are the benefits of the device?

We have chosen the Nayax Onyx payment device which is an industry leader. It’s simple to use the device, and it can even talk users through the process (in 20 different languages).

The system can be managed remotely and offers a wide range of sales data in real-time, meaning that you can truly understand user personas and buying trends.

Is there a way that I can encourage customer loyalty?

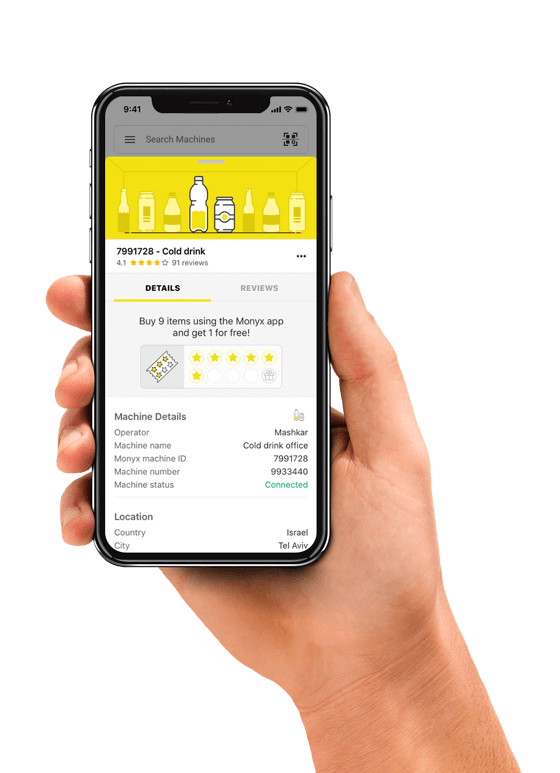

The Nayax Onyx works hand-in-hand with the Monyx Wallet payment app. This app enables users to track spending, win prizes and save money every time they top up their account.

What does this mean for users?

- 10% extra credit is added to their account every time they top-up by just £10

- Return custom and loyalty is rewarded with gifts and the ability to play games (to win a prize)

- Users can track their spending with a complete payment history

- Refunds are quick and simple as users can be refunded instantly through the online management portal (if they do not receive their chosen product)

* Taken from a Finextra article published November 2020.

Buy Vending Machine | Rent vending machine | Lease Vending Machine | Stand alone Vending Machine | Multiple location Vending Machines | Your Trusted Vending Supplier

Refreshment Systems Ltd is one of the most trusted vending machine suppliers in the UK. Whichever option you require either Buy Vending Machine | Rent vending machine | Lease Vending Machine | Stand alone Vending Machine | or Multiple location Machines. RSL is always by your side providing the best vending service nationwide.

Benefits of Getting a Coffee, Snack or Drink Vending Machines from Refreshment Systems

There are many advantages of vending . It is a way to keep your colleagues, clients and visitors refreshed throughout the day. It comes with a reduced cost compared to a fully manned refreshment station at work. With RSL, all our machines are fitted with telemetry units to make coffee machine management more efficient, reducing downtime and ensuring your machines are always stocked.

Take workplace refreshments to the next level with buy new vending machines from Refreshment Systems. RSL is a leading National vending supplier. Our unbeatable range of machines can be purchased outright or leased.

You will always have an option to lease vending machine, Buy vending machine or rent vending machine from RSL. Complete freedom of choice and various service packages available up to completely managed vending solution tailored just per you and your customers needs.

If you want to hear more about our product and services, get in touch with Refreshment Systems on 0800 169 3686.

Or via our contact form.

Check out our social pages for more news and offers that the vending world and RSL are offering.

Our Facebook Page: @refreshmentsystemsltd

Our LinkedIn Page: Refreshment Systems Ltd

Our Twitter: @RefreshmentSys